Our Services

Your Success

Domestic Warehousing Services

BWT’s Domestic Warehouses offer a suite of services including inventory management, order fulfillment, product customization, 3PL services with JIT capabilities, monitoring of stock by expiration and lot, labelling, gift packing, barcode printing, quality assurance, goods disposal, and operate FDA-compliant, climate-controlled facilities.

- Inventory Fulfillment

- Distribution

- Kitting & Product Customization

- Monitor (Product Expiration / Lot Control)

- Labeling

- Gift Packing

- Barcode Printing

- Quality Checking

- Goods Disposal

- FDA Compliant Facilities

- Climate Conditioned Warehouses

U.S. Customs Bonded Warehousing Services

BWT’s Bonded Warehousing services offer significant financial and operational benefits such as: deferring customs duties, improving cash flow, enhancing customer service by meeting demand promptly, ensuring quality and security with advanced systems, providing easy port access to reduce logistics costs, insuring goods with higher limits, and leveraging Class 3 Bonded Warehousing for international shipping, with options for long-term duty-free storage or efficient asset consolidation for export, potentially reducing tax expenses by 25–30%.

1. Defer Customs Duty

Payment is due only after the products leave the warehouse and are put on the market for sale. This gives you time to complete any additional pre-sale preparations, and it can also provide a welcome boost to your cash flow during the sale process. If the items are to be exported, the costs of transportation and storage are eliminated. The use of bonded warehousing can help businesses reduce their tax expenses by 25–30%.

2. Improved Customer Service

3. Quality Assurance

4. Enhanced Security

5. Port Accessibility

6. Insuring Goods

7. BWT has Class 3 Bonded Warehousing for International Shipping

One of the most significant benefits of using a Class 3 Bonded Warehouse is a company can import products into a bonded warehouse and store them there until they are needed again. The merchant can choose between two possible paths:

- Importing (IT) – When there is a significant decrease in demand for the products, they can be stored in warehouses until the demand increases. At that point, the importer will be responsible for paying tariffs on the items as they are transported to their final destination inside the country of holding. It is not necessary to import all the goods at the same time. Cargo can be warehoused in a Class 3 Warehouse for up to 5 years Duty free.

- Exporting (TE) – Merchants can hold products at the warehouse to assist asset consolidation before the commodities are exported again. The merchant does not have to pay duty fees till the consolidated products are kept under the supervision of Customs. This avoids the possibility of double taxation.

Grow.

Compete.

Thrive.

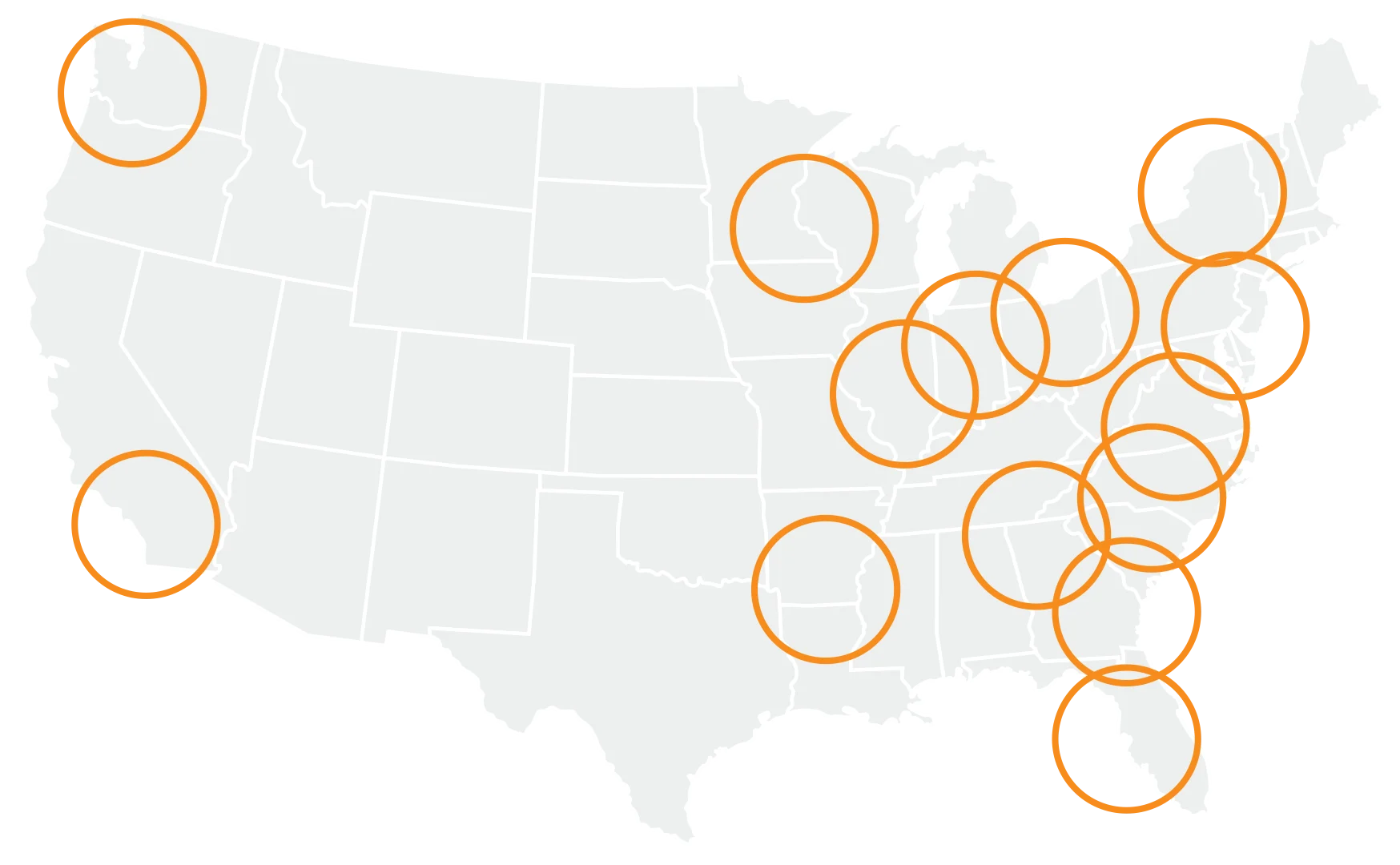

With our flexible warehousing solutions nationwide.

No matter where you are or where you’re going, BWT will be there to support your operations. We want to be your warehousing partner for decades into the future.